SXSW 2016 Economic Benefit to City of Austin Totals $325.3 Million

Wednesday, September 7, 2016 at 2:11PM |

Wednesday, September 7, 2016 at 2:11PM |  4 Comments

4 Comments Austin, TX - September 7, 2016 – South by Southwest® (SXSW) is proud to present the comprehensive economic impact of the 2016 South by Southwest (SXSW) Conference and Festivals to the City of Austin. This analysis represents the tenth consecutive study to fully assess the unique nature of SXSW and its beneficial economic impact to the city. The impact of SXSW’s 30th official event totaled $325.3 million.

SXSW attracts the world’s leading creative professionals to Austin, Texas for an unparalleled event that includes a conference, trade shows, and festivals. For the past 30 years, SXSW has successfully helped creative people achieve their goals while catapulting Austin onto the world stage each March by transforming the city into a global mecca for creative professionals.

“SXSW is an invaluable brand that has helped define Austin as the center of creativity and commerce, a community that is innovative, entrepreneurial and cool. The continued growth of SXSW has resulted in significant benefits for all Austinites,” said Michael W. Rollins, CCE, president of the Austin Chamber of Commerce. “It supports local employment, attracts innovative companies across a broad range of industries who can create much needed middle and high skilled jobs, and pumps hundreds of millions of dollars into our local economy.”

The continued growth of SXSW reflects its singular ability to bring together creative disciplines across a multitude of industries. With keynote addresses from President Barack Obama, First Lady Michelle Obama, producer Tony Visconti and presentations by Twitter co-founder Biz Stone and director J.J. Abrams, SXSW 2016 provided unprecedented opportunities for creative cross-pollination. In addition to the core SXSW events—Interactive, Film, and Music—SXSWedu also experienced a banner year in 2016.

SXSW continues to be the single most profitable event for the City of Austin’s hospitality industry:

- SXSW 2016 included 13 days of industry conferences, a 4-day trade show, 8 exhibitions, a 6-night music festival featuring more than 2,200 bands, and a 9-day film festival with more than 460 screenings.

- In 2016, SXSW directly booked 14,415 individual hotel reservations totaling over 59,000 room nights for SXSW registrants. Direct bookings by SXSW alone generated $1.8 million in hotel occupancy tax revenues for the City of Austin.

- The openings of the Hotel Van Zandt and Holiday Inn Express, as well as the continued increases in Registrants and short-term rental bookings, helped expand Austin’s lodging capacity and contributed to longer SXSW visits. In 2016, the SXSW registrant hotel stay averaged 5.2 nights each, an increase from 4.9 nights in 2015.

- SXSW Conference and Festivals participants, which includes Registrants and Single Admission Ticket Holders, totaled nearly 140,000.

- SXSW Guest Pass and Consumer Attendees attracted an additional 203,800 participants. These popular free-to-the-public events included the 3-night Outdoor Stage concerts at Lady Bird Lake, the 2-day Digital Creative Job Market, 3-day Flatstock poster art show and Music Gear Expo, 1-day Education Expo, the 3-day SXSW Gaming Expo, SXSW Create, and SXSW MedTech Expo. In 2016, SXSW distributed 119,500 Guest Passes.

“SXSW continues to position Austin in the national spotlight and as a result, the Kimpton Hotel Van Zandt reaches an expanded customer base for the greater part of March,” said General Manager, Joe Pagone. “By embracing the creativity surrounding the conference, we are able to hit the affluent, tech-savvy target audience for our hospitality brand.”

In 2016 the value of SXSW print, broadcast and online publications coverage totaled $223 million. The increase in SXSW’s media valuation reflects a more comprehensive assessment of international media coverage. Keynote addresses by both President Barak Obama and First Lady Michelle Obama saw an upsurge in national and international coverage of SXSW 2016. Media coverage contributes to the Austin’s core identity, elevates the city’s global profile and represents a substantial return on the City of Austin’s relatively modest investment in SXSW.

With the recent unification of the SXSW Conference, expanding badge access, and streamlined programming, SXSW promises to propel the event’s convergence of entertainment, culture, and technology to new heights in 2017.

To read and download the full study, please visit South by Southwest 2016 Economic Impact report or www.sxsw.com/facts-figures-quotes.

# # #

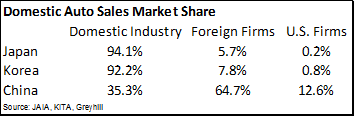

About Greyhill Advisors: Greyhill Advisors is an economic analysis, economic development and site selection consulting firm with offices in Austin, TX and New York, NY. Greyhill represents a team of seasoned professionals with hands on experience performing economic analysis, assisting leading companies in their location decisions and working with communities to expand their economic potential. For more information, visit www.greyhill.com.

About SXSW: SXSW dedicates itself to helping creative people achieve their goals. Founded in 1987 in Austin, TX, SXSW is best known for its conference and festivals that celebrate the convergence of the interactive, film and music industries. The event, an essential destination for global professionals, features conference programming, showcases, screenings, exhibitions, and a variety of networking opportunities. SXSW proves that the most unexpected discoveries happen when diverse topics and people come together. SXSW 2017 will take place March 10-19, 2017.

CONTACT:

Ben Loftsgaarden, Greyhill Advisors Elizabeth Derczo, SXSW

ben@greyhill.com or 512.786.6100 elizabeth@sxsw.com or 512.467.7979